Cash Discount Program Credit Card Processing: A Smart Solution for Merchants

A cash discount program credit card processing is an innovative approach that enables businesses to lower their processing fees while offering consumers an incentive to pay with cash. By adopting this program, merchants can effectively redirect the costs associated with credit card transactions back to the customers, encouraging cash payments and simplifying their financial operations.

Many business owners remain unaware of the significant savings potential this program can offer. In a landscape where credit card fees can sharply impact profit margins, cash discounting presents a pragmatic solution to control costs. As more merchants explore this option, it becomes essential to understand its mechanics and benefits fully.

This blog post will delve into the details of cash discount programs, including regulations, implementation strategies, and the advantages they bring to both businesses and consumers. By gaining insight into this payment model, readers can make informed decisions about whether this approach is suitable for their operations.

Understanding Cash Discount Programs

Cash discount programs incentivize customers to pay with cash, offering them a lower price compared to credit card payments. These programs can benefit both merchants and consumers through reduced processing fees and savings.

Concept and Functionality

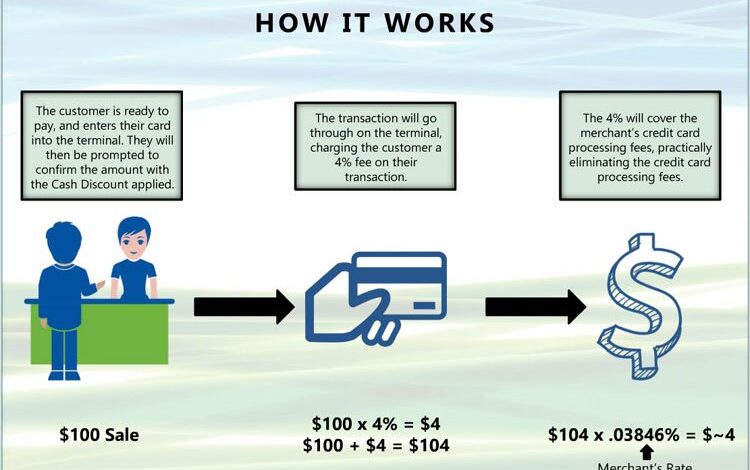

A cash discount program allows merchants to provide a discount on the price of goods or services for cash payments. When a customer chooses to pay with cash, they receive a direct price reduction, which can motivate more customers to use cash, thereby increasing merchant revenue.

Merchants engage in these programs primarily to lower the cost of credit card processing fees. Typically, processing fees can range from 1.5% to 3% per transaction, impacting profit margins. By encouraging cash transactions, merchants can improve their bottom line while providing transparency in pricing.

The pricing structure should clearly reflect the difference between cash and credit prices, often displayed at the point of sale. Transparency is vital, as it fosters customer trust and compliance.

Legal and Compliance Overview

Implementing a cash discount program requires adherence to legal and compliance standards. Most importantly, state and federal laws govern price discrimination based on payment methods. Merchants must ensure their cash discount does not violate any laws in their jurisdiction.

The Truth in Lending Act (TILA) and other relevant statutes should be reviewed to avoid potential legal issues. Merchants need to provide clear signage indicating the cash discount policy and the applicable prices for each payment method. Failure to comply can result in penalties or litigation.

In certain states, cash discounts may be interpreted as surcharges, which are regulated differently. Therefore, it is crucial for businesses to consult with legal experts to ensure their program is compliant and provides the intended benefits without legal repercussions.

Implementing Cash Discount Programs

Successful implementation of cash discount programs requires careful integration with credit card processing, clear communication to customers, and thorough staff training. Each aspect plays a crucial role in ensuring the program’s effectiveness and acceptance.

Integration with Credit Card Processing

Integrating a cash discount program with existing credit card processing systems is essential for seamless transactions. Businesses must choose a payment processor that supports cash discounts and can adjust transaction fees accordingly.

Key steps include:

- Reviewing Current Processors: Evaluate if existing processors offer cash discount program support.

- Adjusting Pricing Models: Ensure that discount amounts are automatically applied at the point of sale.

- Updating Software: Modify any point-of-sale (POS) systems to recognize cash versus card payments.

This integration allows businesses to avoid excessive fees associated with card transactions while promoting cash payments effectively.

Communication to Customers

Clear, transparent communication to customers about the cash discount program is vital for acceptance. It helps to reduce confusion and ensures customers understand the pricing structure.

Effective communication strategies involve:

- Signage: Post clear signs that explain the cash discount at the entrance and register.

- Website and Social Media: Update online platforms with information about the program.

- Direct Conversations: Encourage staff members to actively discuss the benefits of paying in cash during checkout.

This proactive communication approach helps customers feel informed and valued, fostering a positive reception.

Training for Staff

Comprehensive training for staff members ensures they are well-equipped to implement the cash discount program. Understanding the program’s mechanics and benefits will enable employees to handle customer queries confidently.

Staff training should cover:

- Program Details: Educate employees on how the cash discount works and its advantages.

- Handling Objections: Prepare staff to address customer concerns or misconceptions effectively.

- Role-Playing Scenarios: Conduct practice sessions to build confidence in explaining the cash discount to customers.

Trained employees can promote the program effectively, creating a consistent experience for customers and increasing the likelihood of adoption.